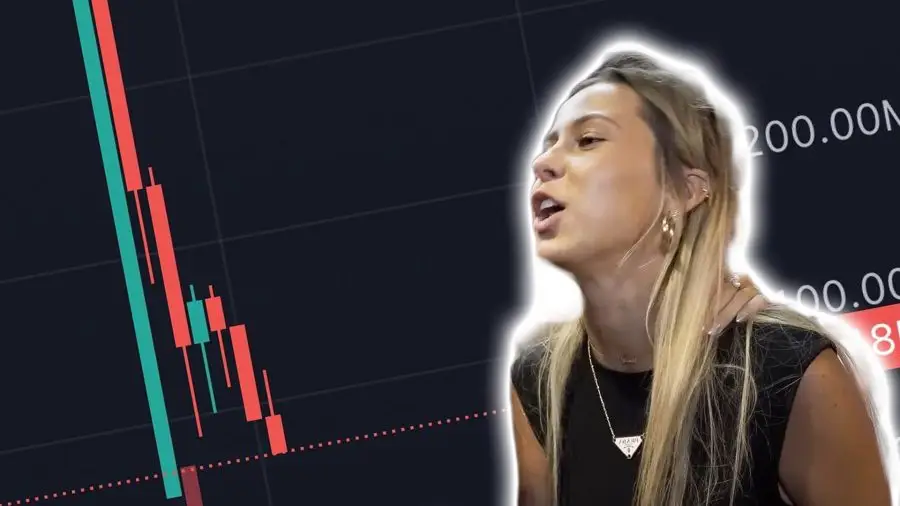

Haliey Welch, the influencer behind the recent launch of the HAWK memecoin, could face significant legal consequences if authorities investigate her token launch. The HAWK coin, which briefly peaked at $490 million before plummeting 91%, has sparked allegations of insider trading, market manipulation, and fee extortion, raising concerns over potential legal violations.

Legal experts believe the United States Securities and Exchange Commission (SEC) could pursue civil charges for securities fraud if HAWK is deemed a security under the Howey test. This could involve claims of misrepresentation or deceit in its sale. Additionally, the Department of Justice (DOJ) could consider criminal charges, including wire fraud or money laundering, especially if there’s evidence of intentional deception or financial misconduct.

On December 4, Welch launched the token, which quickly lost value amid claims that insiders had profited significantly. Over 80 wallets that hadn’t purchased tokens allegedly sold them for profits ranging from $10,000 to $365,000, suggesting pre-launch allocations. Welch has denied insider trading, insisting her team and affiliated figures did not sell tokens or receive free allocations.

Crypto lawyers have warned that if these allegations of trading on insider knowledge are proven, Welch could face serious charges. The SEC’s classification of memecoins, often lacking intrinsic value, remains unclear, but they could be considered securities if marketed to expect profits from the promoter’s efforts.

Possible charges for Welch and her team could include inadequate disclosure, failure to register as a broker, unregistered broker-dealer activity, and violations of anti-money laundering laws. The DOJ could also become involved in criminal investigations, with penalties for securities fraud and market manipulation ranging from hefty fines to years in prison.

Legal experts are advising Welch to secure legal counsel immediately as the situation could escalate with ongoing investigations. While the legal landscape for crypto assets remains in flux, the fallout from the HAWK memecoin launch highlights the growing scrutiny over memecoin projects and their promoters.