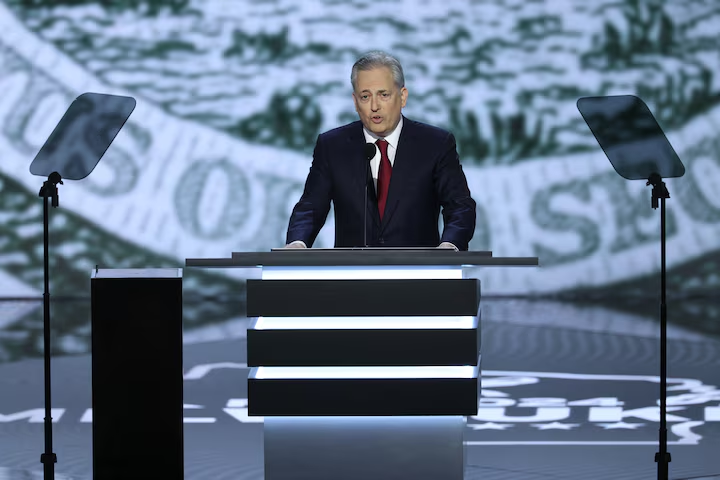

In a bold move aimed at reshaping U.S. digital policy, President-elect Donald Trump announced the appointment of David Sacks, the former Chief Operating Officer of PayPal, as his “White House A.I. & Crypto Czar.” This appointment underscores Trump’s commitment to forging a legal framework that provides clarity and fosters growth in the rapidly evolving cryptocurrency industry. In his announcement on Truth Social, Trump emphasized that Sacks would play a pivotal role in ensuring that the crypto industry thrives in the U.S., although he did not specify whether the title of “czar” was official.

Sacks, a venture capital leader and early advocate for cryptocurrencies, is expected to bring a light regulatory touch to both the artificial intelligence and crypto sectors, a stance that aligns with the views of Trump’s tech backers. His focus will likely be on regulating the use of A.I. in critical applications, rather than stifling the development of A.I. models themselves. Silicon Valley investors have long voiced opposition to excessive regulation in these sectors, fearing it could hinder innovation.

The appointment of Sacks follows Trump’s broader strategy of appointing industry advocates to key positions. Just days earlier, he nominated Paul Atkins, a crypto proponent, to lead the Securities and Exchange Commission (SEC), signaling a strong commitment to aligning government policies with the growth of digital assets.

Sacks, co-founder of the venture capital firm Craft Ventures and a key figure in the PayPal Mafia, is no stranger to the world of cryptocurrencies. Having invested in and supported numerous blockchain projects, he has long been a vocal believer in the transformative power of digital assets. In a 2017 interview, Sacks predicted that the rise of Bitcoin represented the birth of a new, decentralized internet. His expertise in the crypto space, combined with his leadership experience at PayPal and other tech companies, positions him well to spearhead the U.S. government’s crypto initiatives.

In addition to his role as A.I. & Crypto Czar, Sacks will also lead the newly created White House Advisory Council on Science and Technology. This council is expected to play a significant role in shaping future technological advancements and ensuring that the U.S. remains at the forefront of the digital revolution.

The appointment comes as Bitcoin has surpassed $100,000 for the first time, further cementing its place in the global financial landscape. Industry leaders, including Matthew Dibb, Chief Investment Officer at Astronaut Capital, have lauded Sacks’ appointment, citing his deep technical knowledge and commercial acumen in the cryptocurrency space.

With Sacks at the helm, many in the crypto industry are optimistic that his leadership will provide the regulatory clarity necessary for innovation to flourish while safeguarding against potential misuse of new technologies like A.I. and digital currencies.

As Trump continues to champion digital assets and technology, his administration’s approach to A.I. and crypto regulation will likely be one of the defining features of his term, with the potential to reshape the future of digital innovation in the U.S. and beyond.

Who is David Sacks:

David Sacks is a renowned entrepreneur and investor in the tech sector. He is a co-founder and partner at Craft Ventures, a venture capital firm he co-founded in 2017. Over the years, he has built a reputation for his successful involvement in various high-profile startups, including PayPal, Yammer, and a number of unicorns like Airbnb, Uber, SpaceX, and Slacs.

Sacks began his tech career in 1999 as PayPal’s first product leader and later COO. His work there helped shape the company’s growth, leading to its IPO in 2002 and subsequent acquisition by eBay. He later founded Yammer in 2008, an enterprise social network that grew rapidly and was acquired by Microsoft for $1.2 billion in 2012.

In addition to his entrepreneurial ventures, Sacks is also a co-host of the popular All-In Podcast, where he discusses tech, economics, and social issues with other Silicon Valley influencers. His investment portfolio includes companies like Affirm, Lyft, and Twitter.